Need help with your Louisiana payroll tax administration? We have just what you need at Canal HR.

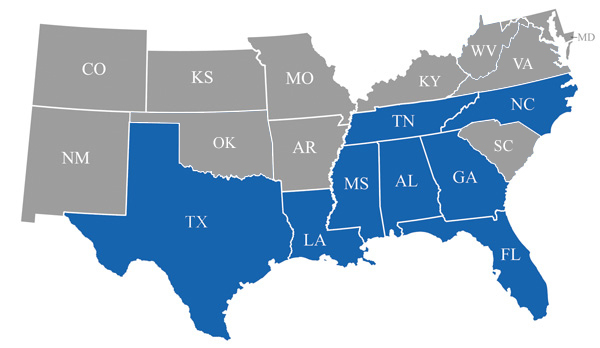

All state laws mandate specific filing requirements that must be met by all employers. In order to maintain compliance, employers must remain familiar with their state’s payroll tax laws. At Canal HR, we work with clients in Louisiana and across the Gulf South, including in Texas, Mississippi, Alabama, Georgia, Florida, Tennessee, and North Carolina.

Canal HR helps keep you stay up-to-date with all state and federal payroll tax revisions, including new legislation regarding rates and reporting requirements. We ensure compliance with these changes and relay any pertinent information that may concern your company’s operations.

We guarantee that your Louisiana payroll taxes will be paid appropriately in a consistent manner. In addition, we will help you file all payroll related tax returns, such as federal and state withholding and unemployment returns, as well as all quarterly and year-end returns, including W-2 forms.

With our help, you can concentrate on your business without all the hassles and distractions caused by payroll tax administration and compliance.

Whether you are a Louisiana-based company or have employees that work remotely in Louisiana, there are certain Louisiana payroll tax requirements that employers must perform to comply with state tax laws.

Employers who withhold or are required to withhold Louisiana income tax from paid wages to employees are obliged to file a withholding tax return. Although there are only three forms that you must file for income tax withholding, they have very strict deadlines.

Failure to withhold and pay Louisiana payroll tax returns on time will result in the employer being personally liable for the amounts not withheld.

Businesses operating in Louisiana must complete and submit an employer application to determine if they are liable or non-liable for unemployment tax. If you are liable, Form LDOL-ES4 Employer Wage and Tax Report must be submitted quarterly, by the end of the month that follows a calendar quarter-end.

Although you can conveniently file your Louisiana payroll tax forms online, you still need to remain careful when preparing your forms. Our professional team at Canal HR gives you a second set of eyes when it comes to properly calculating, filing, and submitting your payroll form requirements.

With Canal HR, you gain access to payroll specialists that have multiple years of experience accompanying businesses with streamlining their payroll processes. When it comes to tax preparation, there’s nobody that gets the job done better than Canal HR.

Outsourcing your Louisiana payroll tax responsibilities to us will safeguard your business from making mistakes with payroll. The payroll process is a very complex entity and one small overlooked detail can lead to a great loss. With our expert help, you’re guaranteed sound payroll tax processing every time.

We will alleviate the stress of payroll processing and tax compliance off your shoulders by seamlessly aligning with your current business workflow and other working departments. Along with tax preparation, we will assist you with many other payroll related duties including:

Professional employer organizations like Canal HR can help you save time, money, and grant you access to industry expertise.

Businesses large and small can benefit significantly from allowing Canal HR to administer their payroll tax obligations. From cost savings to access to payroll expert knowledge, your business will experience the many advantages of outsourcing your payroll responsibilities to Canal HR.

When you administer your payroll activities in-house, you may end up spending way more than you bargained for. Every time you process payroll and print checks, reports, and other forms, you spend a large portion of your office resources—increasing your costs to replenish the used goods. Canal HR can help you reduce your costs that are required to process your payroll activities because we handle everything for you with our own resources.

State and federal tax regulations, withholding rates, and government forms are constantly changing, which makes it difficult for your staff to stay up to date with the latest revisions while maintaining their normal responsibilities.

Our professional team of payroll experts will help you decrease the time it takes to perform your company’s necessary payroll duties. We make it easier for you to administer ongoing payroll through reduction or increase in compensation structure and filing of reports to government authorities.

With our help, you’ll avoid payroll filing mistakes that can result in harsh IRS penalties at the end of the year.

Are you ready to get your Louisiana payroll tax administered by Canal HR, the best PEO in the Gulf South? Contact us to receive your free consultation today!